Hotel occupancies

Reflections on the 2023 summer season

In the aftermath of the pandemic, Devon and Cornwall – renowned for their stunning landscapes – saw a remarkable influx of domestic travellers in 2022. Hotels in both counties, whether coastal gems or nestled in picturesque countryside, recorded impressive occupancy rates, a clear indicator of the public’s desire to re-explore these iconic destinations.

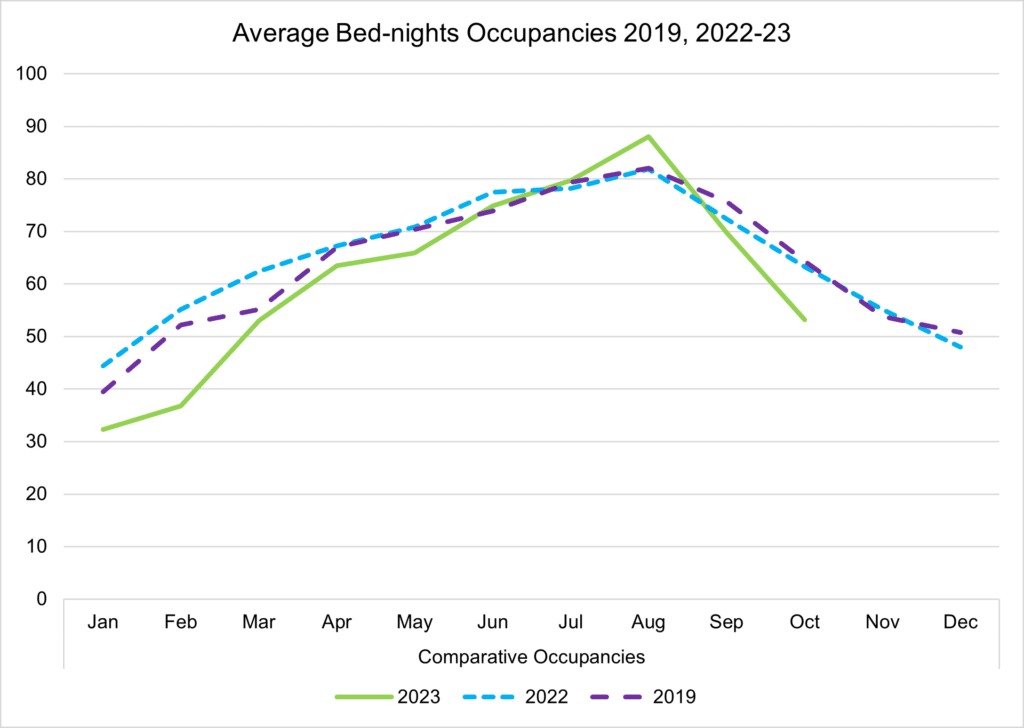

As a result, our South West hotel occupancies tracker shows that bed-nights statistics in 2022 marginally surpassed the pre-pandemic levels of occupancies in 2019. Unfortunately, this did not continue in 2023. Overall, month-on-month bed-nights statistics dropped by around 10% – except for July and August, where occupancy levels for 2023 were above that of 2022 and 2019.

This year, the hospitality industry has struggled with issues such as rising interest rates and employee retention. Hopes were high for the Coronation and summer bank holiday weekends to boost hotel occupancies with staycations and domestic getaways. Yet these opportune occasions missed the mark for many hospitality businesses in Devon and Cornwall.

According to an analysis by the National Coastal Tourism Academy (NCTA), almost half of businesses assessed had a worse turnover than in 2022. Only a quarter of businesses said their turnover improved in comparison to last year.

Despite the difficulties faced by the sector this year, 46% of all businesses in the UK are feeling confident about the next six months. Although, accommodation businesses are feeling the least confident about their business and turnover.

Hotel occupancies: Data analysis

As a firm, we have curated a database of results, which we can use for benchmarking purposes, to assess the performance of the sector in the South West. Our hotel occupancies report aims to distil the key elements of performance for hotels in Devon and Cornwall. The focus of this report is on hotel occupancies, profit and losses, as well as overall performance.

With the economic downturn, there has been a sharp rise in costs, which is the most significant contributor to the reduction in profit this year. This explains why there is an almost 60% rise in total revenue in 2023 compared to 2022, yet average profits have dropped by approximately 5%.

Furthermore, there has been a reduction in the overall occupancy rates by 10%. Occupancy rates for hotels of all sizes in Devon and Cornwall sits at 54% for January-October 2023. Whereas the overall average occupancy level in 2022 was 64%.

A statistical breakdown of income shows a 1% rise in accommodation, roughly 7% rise in food, and an 8% fall in revenue from other sources of income – including hotel spas, bar and drinks takings, and self-catering properties.

Possible explanations for these dramatic shifts in proportion are:

- The inflation spikes that have caused food to increase in value

- Businesses having to partially pause trading where there has been a lack of staff

Struggles in the hotels sector

According to the Office for National Statistics (ONS), only 10% of all businesses in the UK experienced a shortage of workers during the summer season of April-October. Yet, a quarter of all businesses in the hospitality industry experienced a shortage of workers during the same period. This figure rose to almost a third of hospitality businesses in July.

This has affected nearly all hospitality businesses, with almost 70% of employees having to increase the number of hours they worked. On top of this, almost 30% of hospitality businesses had to pause trading altogether in September.

Furthermore, over 60% of businesses in the sector raised their hourly wages during the new financial year in April. This was a dramatic increase, especially in comparison to the majority of businesses in other sectors across the country. However, our database shows the percentage of wages as a cost has stayed the same at 43%, despite the surge in salaries.

The ONS also states that, although the majority of hospitality businesses did not experience a disruption with their supply chain during the summer season this year, over 17% have had to change suppliers. It’s important to regularly review your supply chain resilience, consider which parts are essential and any risks that could cause a break in supply. Consider building trading relationships with alternative suppliers if you identify any issues with current suppliers.

Hotel occupancies: Looking ahead

As the busy summer season in the leisure and tourism sector has drawn to a close, the winter season is an opportune time for reflection on what worked well this year and what can be improved on next year. Think about the four Rs for your business: recruitment, retention, retraining and reward.

There is a large focus for businesses in the South West to invest in their teams (49%) and introduce new technology (28%). The ONS reports that hospitality businesses are experiencing an increasing demand for workers to have basic digital skills. In the month of October, demand for workers with manual skills more than doubled, whereas demand for management and leadership skills have halved.

These demands line up with all businesses in the South West, as well as good customer service skills, which is expected for the nature of work in the industry. Plus, the NCTA reports that the key recruitment challenge is filling more specific roles, such as chefs and kitchen staff, waiting and bar staff, front of house and maintenance staff.

The main concern for hospitality businesses going forward is still the elevated cost of energy. There are growing concerns for business rates and competition, and tax concerns are dwindling. There is also a growing concern for falling demand of goods and services, which is the main concern for businesses in the South West.

We are continually growing our hotels database to provide in-depth analysis on the health of the sector. If you are interested in working with us and receiving individual reports tailored to your hotel business, please get in touch with our marketing team.

Equally, if you have any queries or concerns related to the financial wellbeing of your hospitality business, please do not hesitate to with one of our hotel accounting specialists.

Written by