Making tax digital – all you need to know

What is making tax digital?

Making Tax Digital (MTD) means fundamental changes to the way the tax system works. HMRC’s ambition is to become one of the most digitally advanced tax administrations in the world. In the short term this means businesses like yours will be required to make, preserve and then submit your existing tax records digitally.

Businesses are increasingly seeing the benefits of digitisation. Millions of businesses are already banking, paying bills and interacting with their customers or suppliers online, and many are already using accounting software.

Making tax digital integration should eliminate many of the existing paper-based processes. This should mean that businesses can devote more time and attention to maximising business opportunities, but it will need companies to embrace good financial planning.

How does making tax digital affect you?

To comply, you will need to use HMRC approved compliant software to digitalise the way you keep your books.

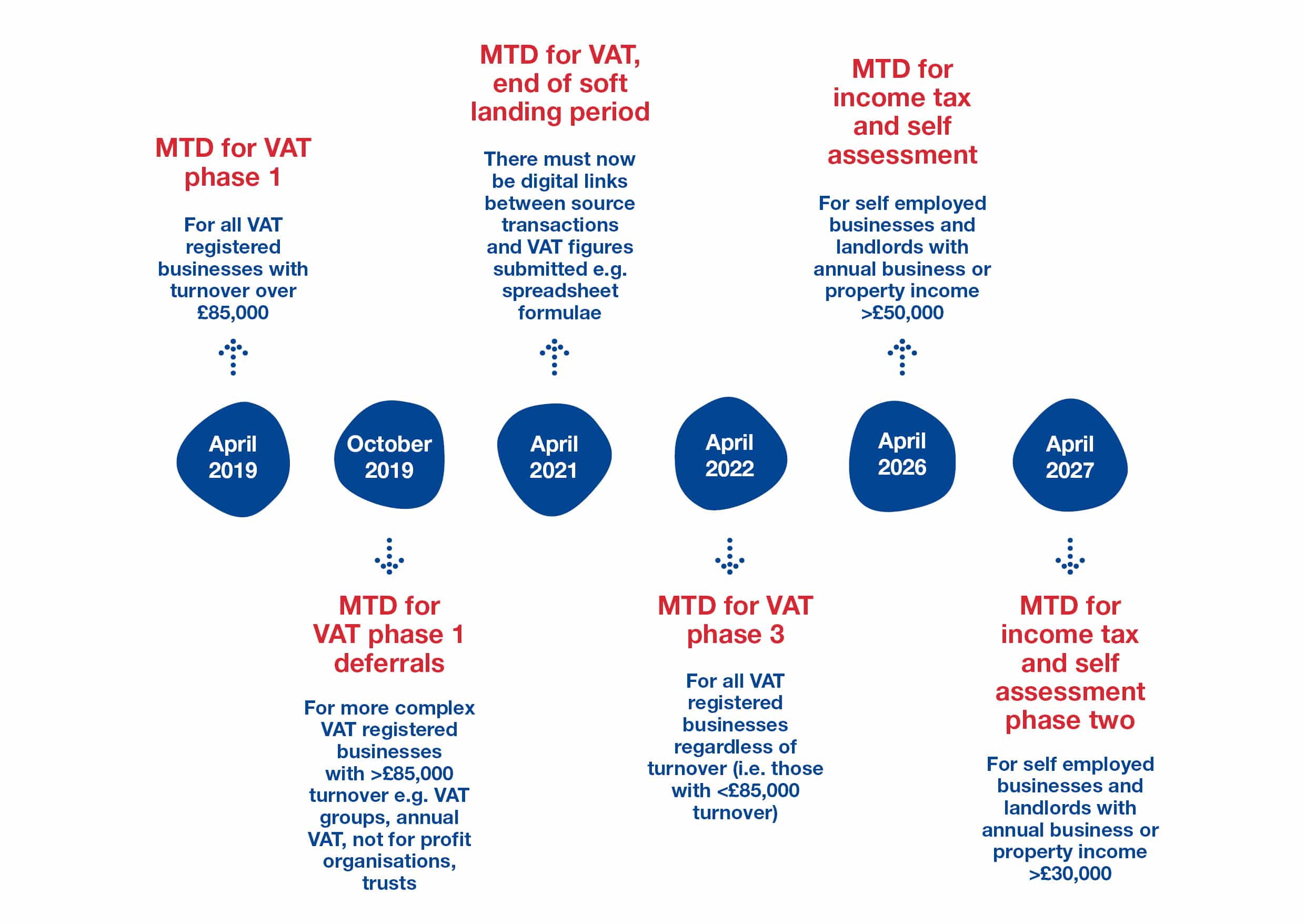

The timeline

Click on the above timeline to enlarge

MTD for income tax self-assessment (ITSA)

April 2026

All self-employed individuals and landlords with annual business or property income above £50,000 will need to comply.

April 2027

Individuals and landlords with total income between £30,000 and £50,000 will be required to comply.

This will revolutionise the tax return process. All affected individuals will need to submit quarterly returns of summarised income and expenditure. Gone are the days of producing a single yearly return only in the depths of January.

> Making tax digital for income tax self-assessment (MTD for ITSA)

MTD for VAT

VAT was the catalyst for making tax digital in 2019. This impacted all businesses with the taxable turnover above the VAT threshold. In 2022, all voluntary VAT registered businesses were required to join MTD.

The HMRC VAT portal has now closed. Unless an exemption is granted, HMRC will automatically move businesses over.

> MTD for VAT further guidance

> MTD for VAT FAQs

MTD for corporation tax

With the delays to MTD ITSA being announced it is now unknown when MTD for corporation tax will take place.

MTD and cloud accounting

Where it’s right for the business our recommendation is a move to Cloud Accounting. MTDfV, MTD ITSA and cloud accounting are a real opportunity to truly digitalise the way you work.

There are a variety of products on the market that provide benefits beyond the basic bookkeeping functionality that can really benefit a business. It can deal with the removal of the manual entry of invoices and bank transactions, to giving you electronic payment solutions, automating debt collection, and industry specifics such as property management, manufacturing and wholesale stock tools, webshop and till systems, etc.

Cloud accounting with us is about more than just software, it’s a way of working together to achieve your business goals. With remote log-in we’ll be able to guide your business and spot potential issues or tax planning opportunities early on. Access to real-time, business critical information allows you to spot patterns and trends quickly and take advantage of them.

Get in touch

Find out how our cloud accounting team can help you today.