Sale of family-owned funeral directors paves way for growth

Family-owned funeral directors and memorial masons Grassby & Sons has been sold to Lighthouse Funerals, an investment vehicle of fund manager Downing.

The acquisition represents the cornerstone investment in Downing’s plans to build a national network of funeral directors under the Lighthouse brand.

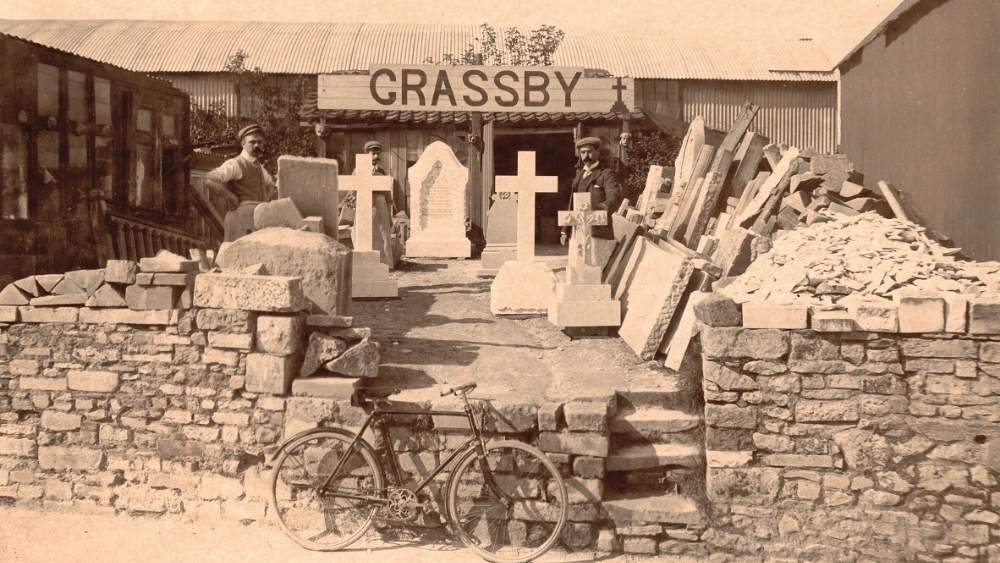

Sixth-generation family business Grassby & Sons was established as a stonemason in Dorchester in 1861. Since branching out into funerals in 1970, the business has expanded organically and through acquisition, and now operates eight funeral directors serving Dorset and East Devon.

Pre-transaction, the business was owned by brothers Peter and David Grassby and David’s son Nick. Nick will take a senior role in the new group, working closely with incoming Lighthouse Funerals CEO Steven Wilton, whilst both he and Peter will continue to lead the Grassby business.

PKF Francis Clark’s corporate finance team advised the Grassbys following approaches from two potential buyers through to successful completion of the deal.

“This transaction is a landmark in the history of Grassby & Sons. Our partnership with Downing and Lighthouse Funerals will allow us to bring our exceptional level of professional, sympathetic funeral services to more families across the region as we continue to grow.

“Having worked closely with Steve Wilton and the team at Downing throughout this process, I am confident our family business has found an excellent home for the next chapter of its journey, and we look forward to continuing to thrive under their stewardship.”

Peter Grassby

“The process itself was an eye-opener – in particular the intensity of the due diligence process and the huge range of commercial, financial and legal issues that needed to be examined and resolved.”

“The team at PKF were always available to guide us at every turn, from negotiating initial offers to meet our value aspirations at the outset all the way through the process to completion. Their sensible, objective advice kept us focussed on the key commercial issues and allowed us to understand and resolve points of contention quickly when they arose, whilst their work behind the scenes both on our underlying data and in controlling the whole process helped ease the strain on our internal team. The level of support was outstanding, and the entire team was a pleasure to work with.”

Nick Grassby

Chris Potts, corporate finance director at PKF Francis Clark, said: “This was an intense but relatively smooth deal process, delivered to a tight deadline thanks to the hard work and pragmatism of the Grassby family, Downing and all of the advisors involved.

“Having been appointed following receipt of initial offers, through detailed financial analysis and creation of competitive tension we were able to negotiate significant increases in valuations commensurate with the quality of the Grassby business. This value was protected through to completion thanks to thorough preparation for, and close management of, the due diligence process.

“The funerals market remains a fragmented sector which is ripe for a new major player. The opportunity to play a pivotal part in Downing’s ambition to grow a high-quality group in the industry was the differentiating factor between the potential buyers, and we look forward to seeing Grassby & Sons playing a key role in the development of Lighthouse Funerals.”

“The acquisition of Grassby & Sons, which has a strong financial track record and expert, trusted staff, is an important first step for Lighthouse Funerals and we look forward to supporting the management team as they grow the business.”

Ed Motley, associate director at Downing

PKF Francis Clark’s lead advisory team comprised Paul Stout, Chris Potts and Ashley Barton, with tax advice provided by Damian Lannon and Michelle Cordy. They worked closely with James Driver and Paul Beer at Kennedy Legg, accountants to Grassby & Sons.

Legal advice to Grassby & Sons was provided by Nick Gent, Mark Nixon, Jonathan Sherman, Gerta Xoxi and Bethanie Watson, at Trethowans. Downing was advised by Cooper Parry (financials) and Shoosmiths (legals).

Featured experts

Chris Potts

Director, corporate finance

Damian Lannon

Partner, taxLatest news

Selling your business?

Maximise value with practical expert advice from our award winning team of experienced dealmakers.