Digitalisation of Bookkeeping: how it is positively impacting UK businesses

The Government’s introduction of Making Tax Digital (MTD) has been the catalyst of digitalisation in the bookkeeping world. Whilst it has created the compulsory need to use compliant digital software, businesses have also reaped further benefits from using such software.

Gone are the days of rummaging through a box of receipts and expenses to collate a last minute VAT return. Instead, businesses are using popular cloud softwares such as Xero and Quickbooks Online which can quickly produce a real-time accurate VAT return which can then be submitted to HMRC at the click of a button.

Not only do cloud software solutions comply with compulsory reporting, they cut down hours of manual processing with the use of clever AI technology. You can go paperless thanks to receipt capture functionalities and send professional invoices straight from the software.

Keeping your records easily up to date on the cloud allows you to get more from your data. For example, you can connect to third party apps to meet your business requirements or produce customised reports to cover what you need.

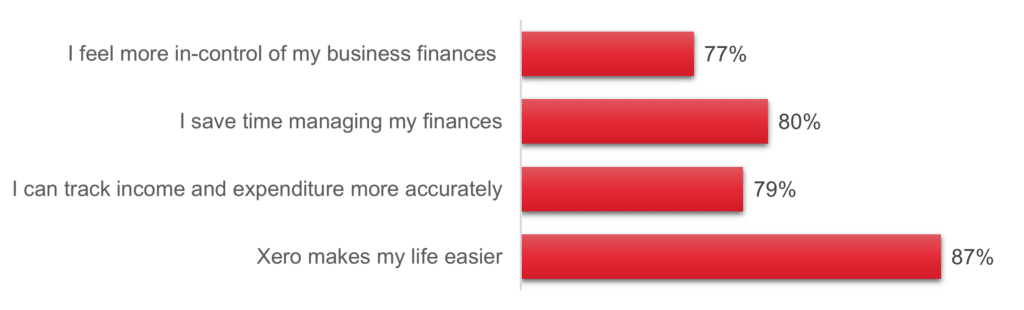

Businesses who changed to MTD for VAT are now enjoying the benefits

Businesses who have previously used spreadsheets or pen and paper and now use Xero for VAT feel the change is positive:

Source: Xero survey August 2021, based on 237 ex-spreadsheet users

It’s better to make the switch sooner rather than later!

With MTD for Income Tax Self Assessment (MTD for ITSA) approaching in April 2026, individuals with business income and property income exceeding the threshold will soon be required to digitalise.

This may feel like a daunting change for some, so it is best to adapt now and embrace small changes ahead of the deadline. Consider using a separate business online banking account, encourage the use of electronic invoicing over paper and attend webinars provided by cloud software so you get a true feeling of the software and its capabilities.

For more information, please contact our cloud accounting specialists, or your usual PKF Francis Clark contact.