Director national insurance contributions: March 2025 is coming

When we receive a query like – ‘I have received my March payslip and there is a change in my national insurance contributions?’ our first question is, ‘are you now, or have you been a company director this tax year?’

Do company directors pay National Insurance?

Yes, company directors pay National Insurance contributions. They are considered employees and when a director is added to the payroll, a decision needs to be made as to which method is used to calculate the national insurance contributions NICs. The Standard (director) method, or the Alternative method.

How much National Insurance do company directors pay?

Standard method

This method provides the director with their full annual allowance upfront. As a result, they only start paying national insurance once they exceed the relevant thresholds. For the 2024-25 tax year, the employee primary threshold is £12,570.

The NIC calculation is done cumulatively, making it suitable for directors with irregular or highly variable pay. This approach adjusts the contribution figure throughout the year.

Alternative method

This method treats the NIC calculation on a non-cumulative basis, looking at the earnings in the pay period only, this is the same way it is calculated for an employee.

This method is usually used for directors who are paid regularly, as the contributions would likely be consistent throughout the year.

Regardless of which method is used, they should be recalculated in March during the final pay run for the tax year. This ensures that any underpayments or overpayments are adjusted based on the total earnings for the year.

Please note: If an employee became a director partway through the tax year, the allowance is pro-rated, and the calculation will only look at earnings and deductions since becoming a director. However, if a director resigns but stays on the payroll as an employee, their NICs will continue to be calculated as a director’s until the following April, when they switch to the regular employee method.

Example scenario

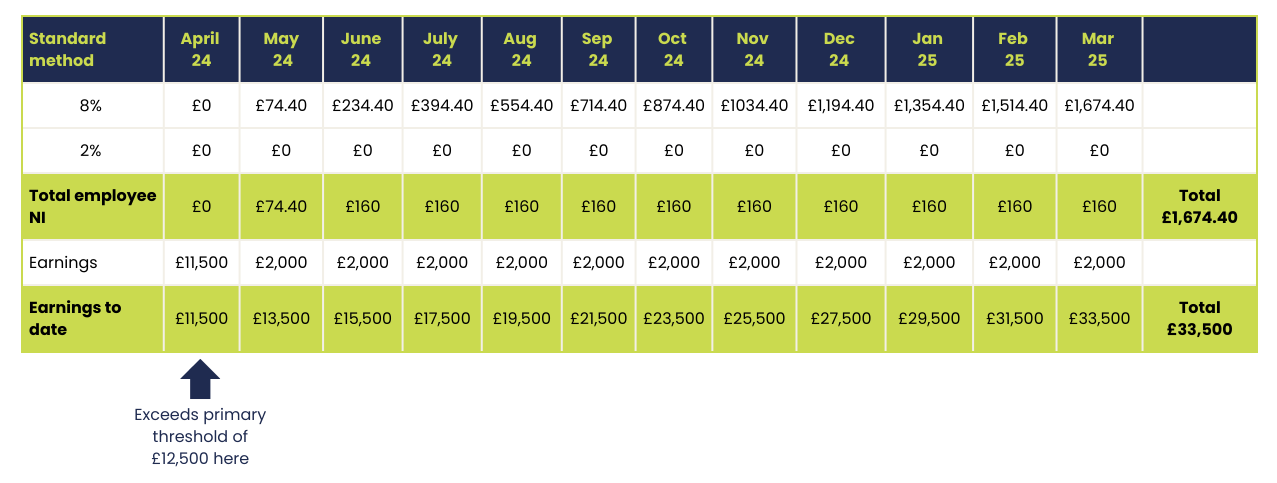

A director in the 2024-25 tax year earns a standard salary of £2,000 per month and receives a £9,500 bonus in April.

Using the standard method, this director would start paying 8% NICs in May, once their earnings exceed the annual primary threshold of £12,570. They would continue to pay NICs at this rate throughout the year, as their earnings do not exceed the annual upper earnings limit of £50,270.

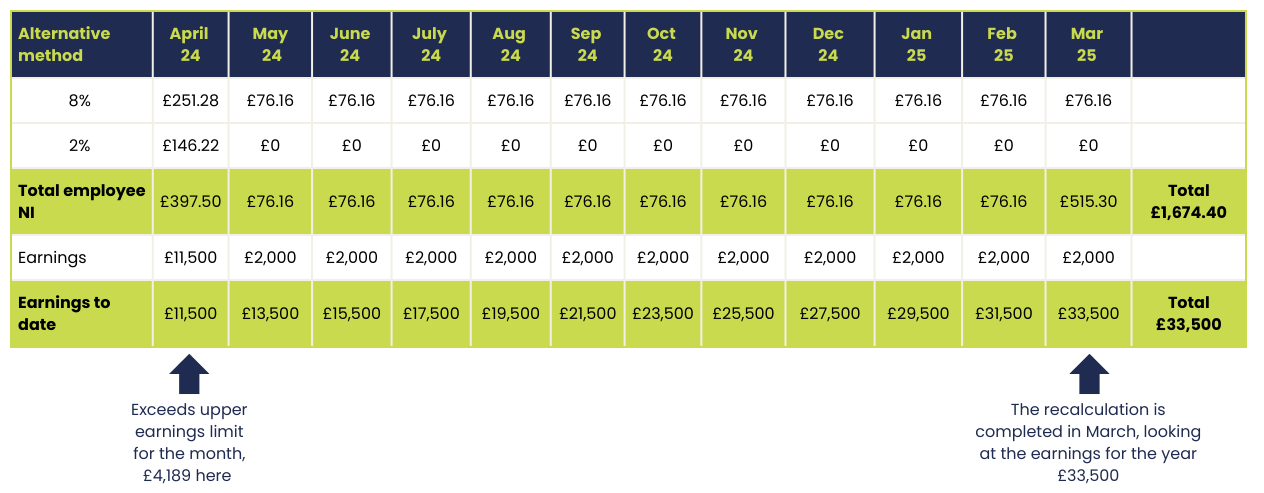

Using the Alternative method, this director would start paying NICs in April, as their earnings exceed the monthly primary threshold of £1,048. Since their earnings also surpass the monthly upper earnings limit of £4,189 in April, they would pay only 2% NICs on earnings above this limit.

Throughout the year, NICs are calculated on a month-by-month basis. However, in March, a recalculation is done using the full annual thresholds. This recalculation identifies any under or overpayments. In this case, since the director’s annual pay does not exceed the annual upper earnings limit of £50,270, they need to pay 8% NICs on all earnings over the primary threshold. This adjustment results in a larger NIC for March.

In both scenarios, the director is paid the same amount (£33,500) for the year and pays the same NICs of £1,674.

Understanding these nuances can help directors manage their finances more effectively and avoid surprises at the end of the tax year.

Beth Hardaker

Head of payroll, east