How can personal pension contributions be used in relation to farm partnerships?

Pensions were first introduced in 1909 and since then have undergone a lot of changes and developments. Currently, they firmly remain as one of the greatest retirement and estate

planning tools available.

In this article, I would like to demonstrate how personal pension contributions can be used in relation to farm partnerships. The simplest way to see how pensions can help you pay less tax now and save for your future is to run through an example.

Meet Bob, 68, and Mary, 67. They are tenant farmers and operate in partnership. They have been working all their lives and they would now like to retire. So, in this tax year they have sold all their farming machinery, cattle and crops – amounting to a total of £250,400. Since their partnership is ceasing, the averaging of profits in the final year of the business is not available and so the full £250,400 is subject to income tax.

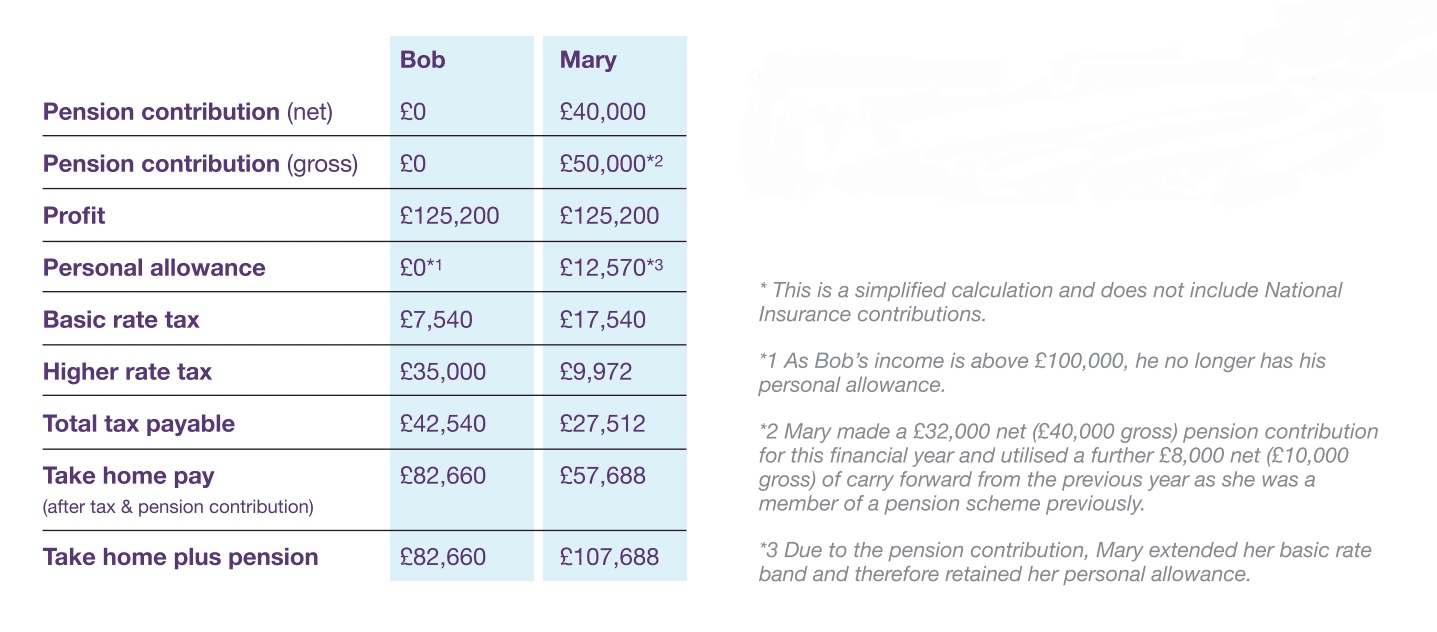

Bob and Mary got in touch with Francis Clark Financial Planning to find out if there is a way of minimising their income tax liability but saving for retirement. After the initial meeting, we identified that neither currently make pension contributions. Bob explained that he doesn’t think that pensions are any good, but Mary was open to the idea and remembered she had one from her first job. Let’s see what difference a personal pension contribution can make to their income tax positions.

Due to Mary’s £40,000 pension contribution, she can save £15,028 in tax and have £50,000 towards her retirement. Due to the availability of carry forward annual allowance

rules, she could, in theory, contribute as much as £125,200 gross to her pension in this tax year.

As well as provision of income in retirement and tax efficient extraction of profits from the business, pensions are also great for estate planning. This is because pensions do not form part of your taxable estate for Inheritance Tax (IHT) purposes. This is especially useful to farmers with children who don’t wish to be involved with their farming business, as they can be left with a pension pot instead. In Mary’s example, she has removed £40,000 from her eventual estate and a potential IHT charge – saving the beneficiaries of her will £16,000.

If you would like to discuss this in more detail or have any questions, please do not hesitate to get in touch with a member of our Financial Planning team.