Management buyout starts new chapter for Crondall Energy

A management buyout at Crondall Energy has seen a large proportion of its team take an ownership stake in the independent offshore energy consultancy.

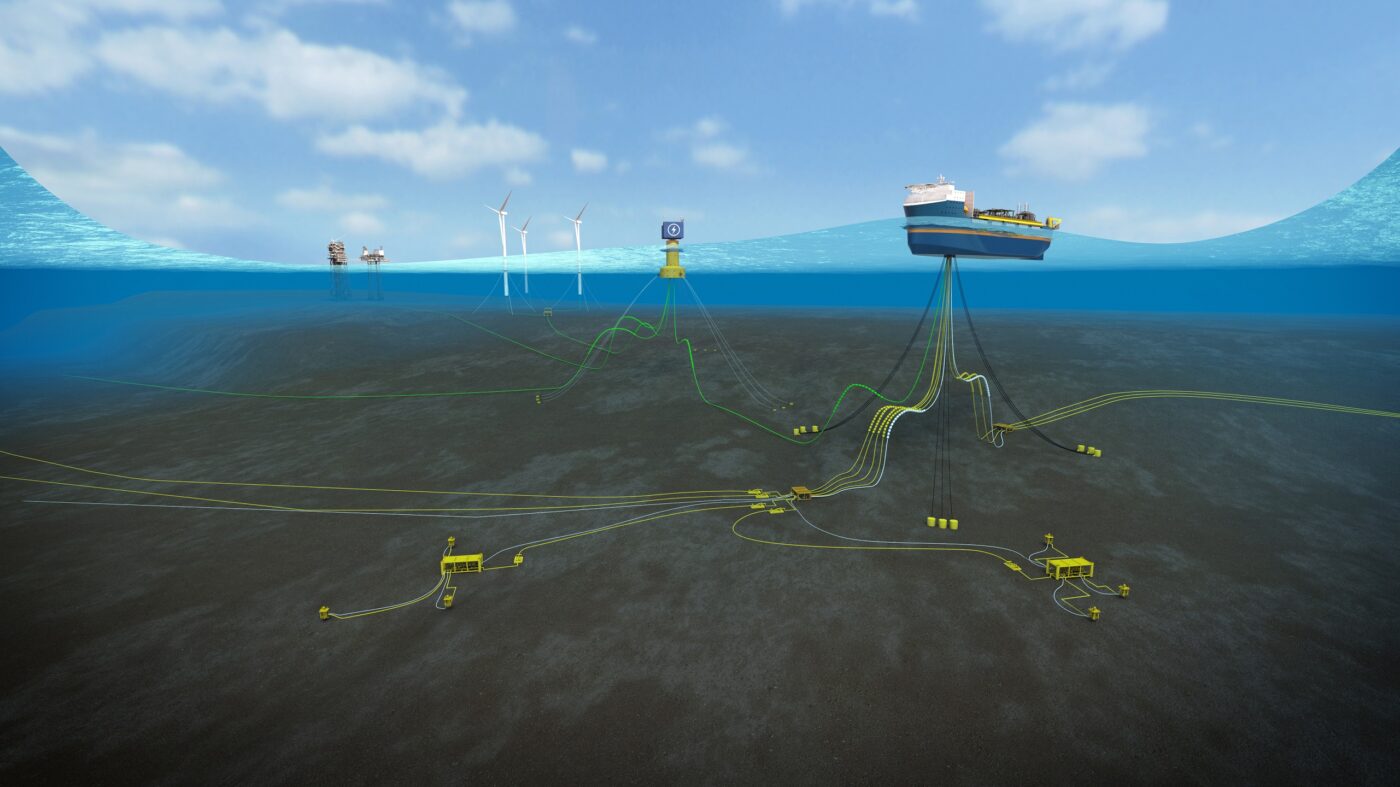

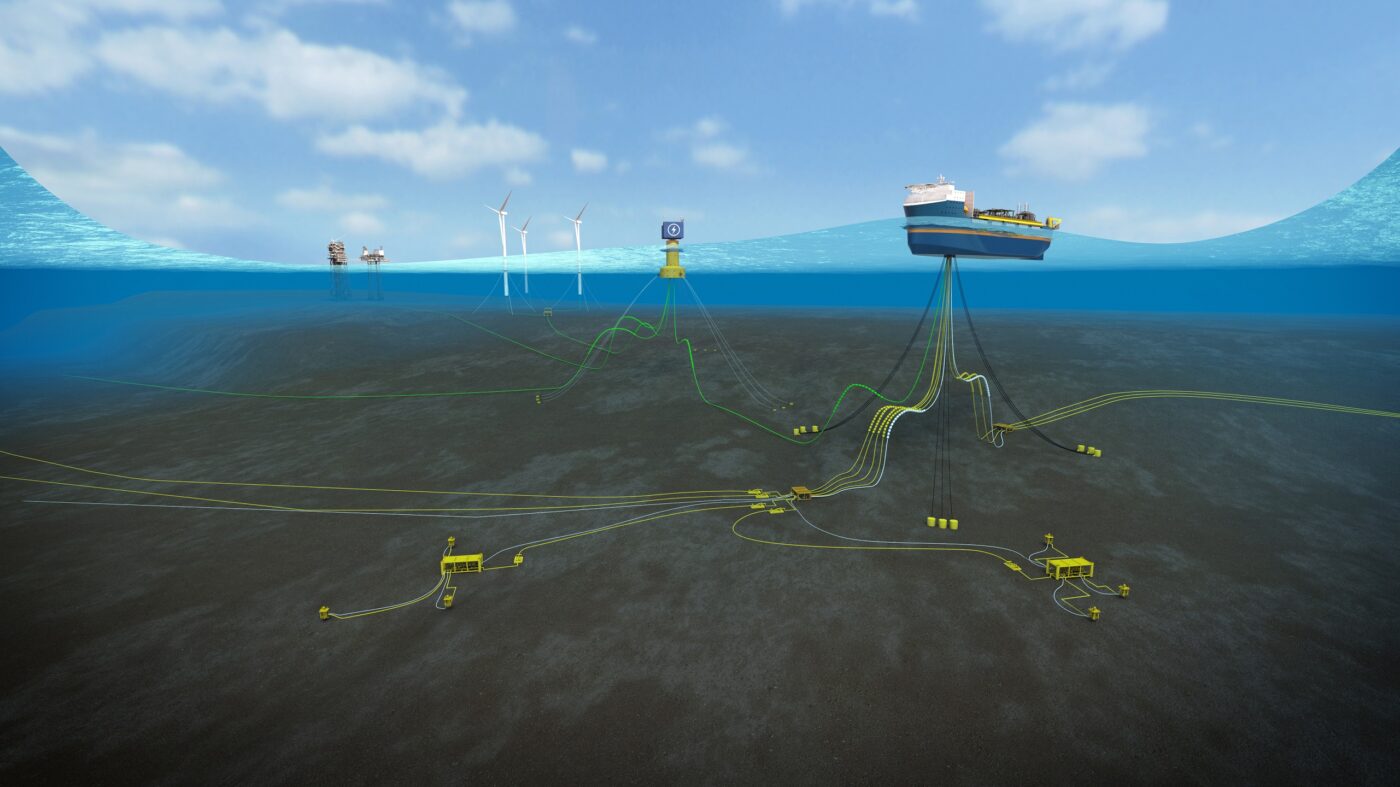

Founded in 2001, Crondall Energy provides strategic, commercial and technical services for offshore energy projects in the UK and around the world, specialising in floating and subsea facilities. The business has a 55-strong workforce based in Southampton, Aberdeen, London, Glasgow, Newcastle, Singapore and Houston.

A team at PKF Francis Clark – comprising Paul Stout, Chris Potts, Ashley Barton, Jeremy Richards, Rachel Addiss and Lisa Whitbread – acted as lead advisors on the management buyout (MBO) process, including feasibility studies, securing funding and deal structuring.

The leadership team at Crondall Energy has long favoured shared ownership of the business as a core component of its ethos; prior to this transaction, 18 directors and employees held shares or options. The MBO sees founder Duncan Peace retain a minority stake in the company as he prepares to retire from full-time executive involvement, whilst retaining a non-executive position on the board. Led by managing director Anna-Louise Peters, 29 staff now own a share of the business as it embarks on the next stage of its journey.

Anna-Louise Peters said: “This is an incredibly exciting and natural next step in Crondall’s evolution. The management team has seen an opportunity to continue the Crondall Energy brand and legacy, capitalising on the fantastic culture and working environment we have created, and continue our development as an independent consultancy firm. We believe that the current market environment creates real opportunity for further growth, particularly in the energy transition and renewables spaces, and that has the potential to create really exciting career and development opportunities for the whole team, alongside return for the shareholders.”

The business is now well positioned to continue the growth journey.

Duncan Peace said: “I am delighted that the future of the company remains in the hands of the management and employee shareholders. The management team under Anna-Louise have shown outstanding leadership both in the development of the business over the last few years – and in the implementation of this MBO. The business is now well positioned to continue the growth journey and deliver on our diversified energy strategy. I look forward to continuing to support the management team through my continued participation on the board.”

In a challenging debt market, we secured a range of funding offers.

Chris Potts, corporate finance director at PKF Francis Clark, said: “Having supported Crondall Energy with several transactions over the past six years, we were pleased to advise on the next step in the company’s succession planning. Having explored various options, we concluded that an MBO was the best route to enable Crondall’s highly skilled and motivated team to capitalise on future growth opportunities whilst facilitating Duncan’s retirement.

“Working to a tight timeframe, our challenge was achieving an optimal balance between enabling Duncan to realise his investment and step back from day-to-day involvement, managing the cashflow needs of the business, and meeting the aspirations of both the existing shareholder base and those seeking to join that cohort, all in a tax-efficient manner.

“This move towards wider employee ownership comes as Crondall Energy is going through a period of significant growth. In a challenging debt market, we secured a range of funding offers and helped the MBO team to select the right option for the business. This appetite from funders is testament to Crondall Energy’s track record of success, strong management team, blue chip client base and ability to stay at the forefront of its industry.

“With a number of exciting projects both under way and on the horizon, we look forward to seeing the business continue to evolve.”

The MBO was funded by a flexible debt facility from ThinCats. Legal advice was provided by Duncan Sykes, Emma Earp, Emma Clayton and Emma Robinson of Foot Anstey.

Read about more of our recent deals.